Key Stock Market Terms Every Beginner Should Know?

1. stock/share A stock, also known as a share or equity, represents a piece of the ownership in the company. When you buy a stock or share of any company, you own a small part of the company. When you purchase a stock, you become a shareholder and gain partial ownership of the company, entitling you to a portion of its profits. Buying a stock does not mean you get involved in day-to-day decisions. Example: Buying a share of Nvidia, Apple, or TATA means you own a small piece of the company, and if the stock price increases, you profit when you sell 2. Stock Exchange A stock exchange is a place where people buy or sell the shares of the companies. In this market, you do not buy or sell anything like fruits, clothes, etc. Basically, it’s a market for trading stocks. This trading can help companies raise money to grow their business and allow investors to own a part of the company and earn a profit if the company does well. stock exchanges provide a transparent and secure platform for transactions. Buyers and sellers place orders through brokers. Example: New York Stock Exchange (NYSE), London Stock Exchange (LSE) 3. Dividends A dividend is a portion of a company’s profits or earnings that is distributed among the shareholders.In simple terms, the dividend is when a company generates revenue or profits at the end of the year or quarterly. It has several options for what to do with that money. Some companies share it with shareholders; some reinvest in the company for growth, and some like to pay off debt or save for future opportunities. Not all companies pay dividends; many of them, like young and growth-oriented firms, prefer to invest their profits in company growth or to fuel expansion. Example: If you own 100 shares of a company that pays a $1 dividend, you’ll receive $100 4. Ask & Bid Price Ask Price: What Sellers Are Willing to Accept It represents the minimum amount of a seller is willing to accept for their stocks or shares. If you are buying a share, you are paying the ask price as that is the price sellers are offering. Example:If the ask price for the same stock is $50.00, it means sellers are willing to sell their shares for $50.00 per share. Bid Price: What Buyers Are Willing to Pay The bid price is a buyers offer. It represents that the maximum amount of an investor is ready to pay for a share. If you are selling the share, you receive the bid price, as that the price at which buyers are willing to purchase. Example:If the bid price for a stock is $49.50, it means that buyers are willing to pay up to $49.50 per share. 5. Investment Portfolio The investment portfolio is the collection of the financial assets you own, such as stocks, bonds, mutual funds, crypto or any other securities that an individual or organization own. The main goal or purpose of investment portfolio is generate returns on the investments while also managing the risks.An Investment portfolio is important because it helps you to manage your investments in a structured way, like it also allows you to diversify risk, achieve financial goals and it provides a clear view of how your investments are doing and making it very easy to adjust as needed. Example of an Investment Portfolio Here is an example of a simple, balanced portfolio for someone with moderate risk tolerance: 6. ETFs Investing An Exchange-Traded Fund (ETF) is a type of investment that consists a collection of assets such as bonds, commodities or a mix of these and they all buy or sell on the stock exchange like the stocks. ETFs is a combination of features of mutual funds and stocks, making them a popular choice among investors. In the ETFs investing, the risk is less than the individual stocks Many ETFs are designed to track the performance of a specific index, such as the S&P 500. Example of Popular ETFs

Understanding the Stock Market: “A Beginner’s Guide”

Understanding the Stock Market: “A Beginner’s Guide” Introduction Investing in the stock market can turn dreams of financial independence into reality, and fortunes are built. You have seen many people who transform their savings into significant wealth. The stock market might seem very complicated at first, like charts, numbers, and fundamentals. But the stock market is not as complicated as it looks.Think of the stock market as a lively ecosystem filled with energy and opportunities. A place where companies can connect with investors and anyone can invest in them. It is the best opportunity to join the success stories that define industries and change the world. What is the Stock Market? The stock market is a marketplace where individuals can buy or sell ownership in companies through stocks, which are also referred to as shares.When a company wants to raise money to grow or expand, it sells a portion of its ownership to the public by issuing stock. When you buy a stock or share of that company, you own a tiny piece of that company. If the company performs well and if its stock or share price increases, it means your investment increases and your investment becomes more valuable. On the other hand, if the company faces challenges and is not able to grow, then its stock price may drop, decreasing the value of its shares.Buying or owning the stock is not only about profits. It’s also becoming a part-owner of a company you invest in. Sometimes, some companies give a chance to vote on important company decisions. How Does the Stock Market Work? The stock market functions through stock exchanges, such as the Indian Stock Exchange (NSE) or BSE. Where the trading of the shares happens in an organized way. Here’s a simple breakdown of how it works: 1. Companies Go Public: 2. Shares Are Traded: After the IPO gets listed on the exchange, now the investor can buy or sell the stake in the company. Investors can trade stocks through brokers, either online or traditional ones. A buyer offers to buy shares at a specific price (bid price), and a seller offers to sell shares at another price (ask price). When both prices match, a buying or selling of shares happens, or, in simple words, we say a trade happens. The price of the stock changes throughout the day based on supply and demand. If more people want to buy stock than sell it, the price goes up. If more people want to sell, the price goes down. 3. Prices Fluctuate: Stock prices are influenced by supply and demand, but there are many factors behind these forces: A company’s performance, including its revenue, profits, and losses, directly affects its stock price. When a company reports strong earnings, it can attract more investors. If demand for buying shares surpasses the supply from selling, the stock price will increase accordingly. So alternately, if the company’s performance is not that good or poor, it can lead to selling and lower prices.

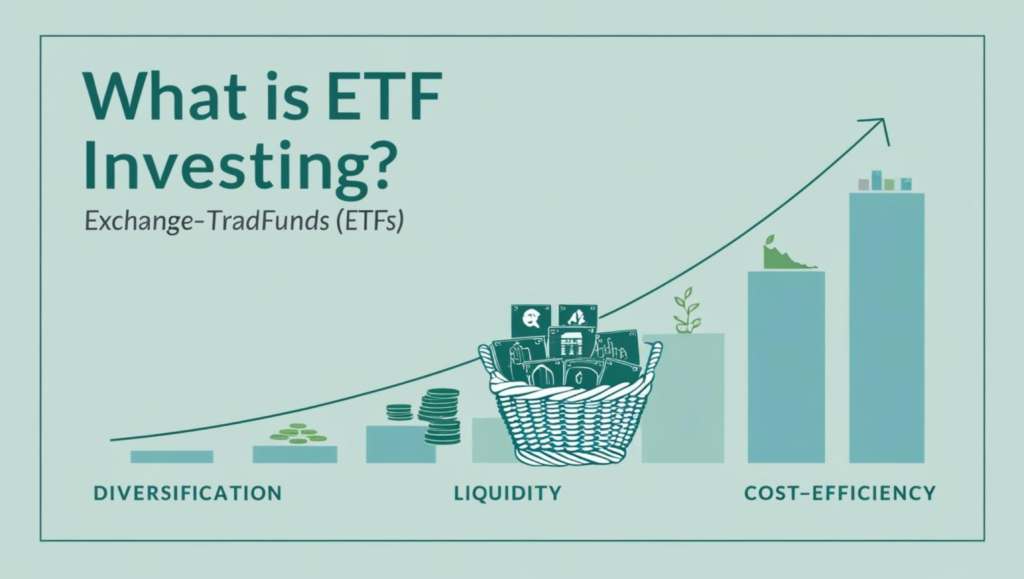

“Mastering the Market: A Beginner’s Comprehensive Guide to Investing in ETFs”

“Mastering the Market: A Beginner’s Comprehensive Guide to Investing in ETFs” In this article: 1. what are ETFs?2. Types of ETFs?3. Benefits of ETFs What Are ETFs? An Exchange-Traded Fund (ETF) is a type of investment that consists of a collection of assets such as bonds, commodities or a mix of these and they all buy or sell on the stock exchange like the stocks. ETFs are a combination of features of mutual funds and stocks, making them a popular choice among investors.In simple terms, an ETF allows you to invest in a basket of assets rather than in just one. In ETF investing the risk is less as compared to the individual stock or a company. To illustrate this, let me just give you an example. If you are interested in the technology sector and are ready to invest in it, you can invest in the ETF of the technology sector instead of buying shares of a single tech company. This allows you to track the performance of a technology sector as a whole, allowing you to spread your investment among multiple companies. Types of ETFs? There are several types of ETFs designed to meet different investment goals:1. Stock ETFs: what are they:Stock ETFs are a collection or basket of stocks that trades on an exchange like a stock, often tracking a specific index or sector. Example: SPDR S&P 500 ETF (SPY): Tracks the S&P 500 index. Best For:Investors seeking diversification and growth potential from the stock market. 2. Bond ETFs What They Are: Bond ETFs are a collection of bonds that are bought or sold on stock exchanges like stocks. They provide exposure to bonds by issuers like government treasures, municipalities, and corporations. Example: iShares Core U.S. Aggregate Bond ETF (AGG): Tracks the performance of the U.S. bond market.Best For:Investors looking for stable income and lower risk.3. Commodity ETFs What They Are: Commodity ETFs are collections of commodities, such as agricultural products, precious metals, and energy resources. They also trade on stock exchanges like stocks.Example: SPDR Gold Shares (GLD): Tracks the price of gold.Best For:Investors looking to hedge against inflation or diversify their portfolios with non-traditional assets.4. Equity ETFs What They Are:The Equity ETF is a fund that only invests in stocks. These ETFs are designed to track the performance of a specific stock market index, sector, or group of companies. They offer investors a diversified way to invest in the stock market, similar to how stock ETFs track stock market indices.Examples: SPDR S&P 500 ETF (SPY): Tracks the S&P 500 index, covering 500 of the largest U.S. companies. Benefits of ETFs 1. Diversification: one of the best advantages of ETFs ie their ability to provide instant diversification. It means instead of investing in individual stocks or bonds, an ETF lets you invest in a basket or collection of assets in one purchase. This reduces the risk of losing money as compared to investing in individual stocks or bonds. 2. Cost-Efficiency: ETFs are mostly cheaper to buy as compared to other investment options, such as mutual funds. Most of them are passively managed, which means they track an index rather than rely on active management, which keeps costs low. The best part about what I like the most is that they have lower expense ratios, which means you keep more of your returns. 3. Liquidity: ETFs are traded as like stocks on the stock exchange. You can buy or sell ETF shares at any time during the market hours. This flexibility is very useful for active traders and also for those who may need to access their money quickly. 4. Transparency: Most ETFs are fully transparent, meaning they publicly disclose their entire portfolio of holdings on a regular basis. This allows investors to see exactly what assets the ETF owns and in what proportions. Transparency helps build trust and ensures that the investor understands what they are buying. 5. Risk Management Tools: One of the best benefits of ETFs is their ability to act as effective risk management tools. Risk is an inherent part of investing, but ETFs offer several strategies to help manage and mitigate that risk. ETFs can play a crucial role in balancing and protecting your portfolio. Risks of ETFs ETFs, while offering numerous benefits, also carry certain risks. Here are some key ones:1. Market Risk: This is the most fundamental risk. ETFs that invest in stocks, bonds, or commodities are subject to market fluctuations. If the overall market (stock market, bond market, etc.) declines, the value of the ETF tracking that market will likely also decline.Example:An ETF tracking the S&P 500 will lose value if the overall stock market declines. 2. Tracking Errors: ETFs aim to mirror the performance of their underlying index or asset, but they may not always do so perfectly. The difference between the ETF’s return and the index’s return is called a tracking error. The return difference is due to its management fees, transaction costs, or imperfect asset allocation. 3. Liquidity Risk: While many ETFs are highly liquid, some ETFs, especially those tracking niche sectors or smaller companies, might have lower trading volumes. This can make it difficult to buy or sell shares quickly, potentially impacting the price you get. 4. Currency Risk: Currency changes can affect international exchange-traded funds (ETFs) that invest in assets denominated in foreign currencies. Even if the underlying assets do well, fluctuations in exchange rates may have an effect on the ETF’s value. 5. Commodities Price Risk: Commodity ETFs are subject to fluctuations in commodity prices, which can be volatile and influenced by various factors like weather, geopolitical events, and supply and demand.

“The Ultimate Guide to Mutual Funds: Invest Like a Pro”

“The Ultimate Guide to Mutual Funds: Invest Like a Pro” In this article:1. What Are Mutual Funds?2. Types of Mutual Funds3. Benefits of Mutual Funds4. Risks of Investing in Mutual Funds 5. How to Choose a Mutual Fund? 6. Examples of Popular Mutual Funds What Are Mutual Funds? Mutual funds are one of the most popular investment options for beginners. A mutual fund is a type of investment that collects money from many investors and invests it in securities such as stocks, bonds, etc. Managed by professional fund managers. These combined holdings are known as the fund’s portfolio. Investors buy shares in mutual funds, with each share representing a portion of ownership in the fund and the income it generates. Mutual funds offer a convenient way to grow wealth without the need for individual stockpicking or in-depth market knowledge. Types of Mutual Funds 1. Equity Funds: The equity funds invest primarily in stocks, offering higher growth potential but also higher risk. Equity funds are suitable for long-term growth and higher returns.Example: Funds focusing on technology or large-cap companies.2. Debt Funds: Debt funds invest in fixed-income securities like bonds. They provide a stable return, and they are generally considered less risky as compared to equity funds. Example: Government bond funds. 3. Balanced Funds (Hybrid Funds): Hybrid mutual funds are investment funds that invest in a mix of stocks and bonds but also may include other assets such as gold, real estate, etc. They offer a balance of risk and return. Example: . ICICI PRU EQUITY & DEBT-G fund, ICICI PRU EQUITY & DEBT-G fund. 4. Money Market Funds: Money market funds are investment funds that invest in short-term, low-risk instruments like Treasury bills. This fund offers a low risk and stable returns. 5. Index Funds: These funds track a specific market index like Nifty 50 and S&P 500. It offers low-cost and passive management. 6. Sector Funds: This fund focuses on specific sectors like healthcare, energy, or technology. This fund has higher risk but the potential for high returns. Benefits of Mutual Funds Risks of Investing in Mutual Funds How to Choose a Mutual Fund? Examples of Popular Mutual Funds How to Start Investing in Mutual Funds

“Systematic Investment Plan (SIP): A Beginner’s Guide to Smart Investing”

“Systematic Investment Plan (SIP): A Beginner’s Guide to Smart Investing” In this article:1. What is a Systematic Investment Plan (SIP)?2. How Does an SIP Work?3. Benefits of SIP4. Types of SIPs5. How to Start an SIP6. Who Should Consider SIPs? What is a Systematic Investment Plan (SIP)? A Systematic Investment Plan (SIP) is a method of investing in mutual funds, and stocks where you invest a fixed amount of money at regular intervals, such as monthly or quarterly. Instead of investing a large sum at once, SIPs allow you to invest small amounts over time, making it easier to start investing. This disciplined approach allows you to build wealth gradually over time, regardless of market fluctuations. How Does an SIP Work? Choose a Mutual Fund:Select a mutual fund scheme that aligns with your investment goals and risk tolerance. Set the Investment Amount:Determine the fixed amount you can easily invest each month or quarter. (e.g., $100 monthly). Schedule Automatic Deductions: Authorize your bank to automatically deduct the specified amount from your account on the chosen date. Invest Regularly:The chosen amount is automatically deducted from your bank account and invested in the mutual fund or in any company stock. Buy Units:Each time you invest, you buy units of the mutual fund at the prevailing Net Asset Value (NAV). Watch Your Investment Grow:Over time, your investment benefits from market growth and compounding returns. Benefits of SIP Disciplined Investing:SIPs encourage regular and disciplined investing, helping you build a habit of saving. Accessibility:SIPs are available for small amounts, making them accessible to everyone Power of Compounding:Regular investments, combined with the reinvestment of returns, create a compounding effect that speeds up wealth growth over time, leading to great returns. Rupee Cost Averaging: By investing consistently, you buy more units when the market is down and fewer units when it’s high, averaging your purchase cost over time. This reduces the average cost of your investments. Flexibility:You can modify, pause, or stop your SIP anytime based on your financial needs. No Need to Time the Market:With SIPs, you don’t have to worry about market timing. Regular investments spread your risk over time. Goal-Based Investing:SIPs can be tailored to specific financial goals like buying a house, funding education, or planning retirement. Types of SIPs 1. Regular SIP: 2. Flexible SIP: 3. Step-up SIP: 4. Top-up SIP: 5. Perpetual SIP: 6. Trigger SIP: 7. Multi-SIP: How to Start an SIP Starting an SIP: A Step-by-Step Guide Additional Tips: Who Should Consider SIPs? Systematic Investment Plans (SIPs) can be a valuable investment strategy for a wide range of individuals, but they are particularly well-suited for: However, SIPs may not be suitable for everyone. If you require immediate access to your funds or have a short-term investment horizon, other investment options might be more appropriate. Remember: It’s essential to assess your individual financial situation, risk tolerance, and investment goals before deciding if SIPs are the right investment strategy for you. Consulting with a financial advisor can help you make an informed decision. Conclusion Systematic Investment Plans (SIPs) are a powerful tool for long-term wealth creation. They allow you to invest a fixed amount of money at regular intervals in mutual funds, regardless of market fluctuations. SIPs offer benefits like rupee cost averaging, compounding, and discipline. They are particularly suitable for long-term investors, individuals with steady incomes, and those seeking to build wealth gradually. By understanding the different types of SIPs and choosing the right plan that aligns with your financial goals and risk tolerance, you can effectively utilize this investment strategy to achieve your financial aspirations.